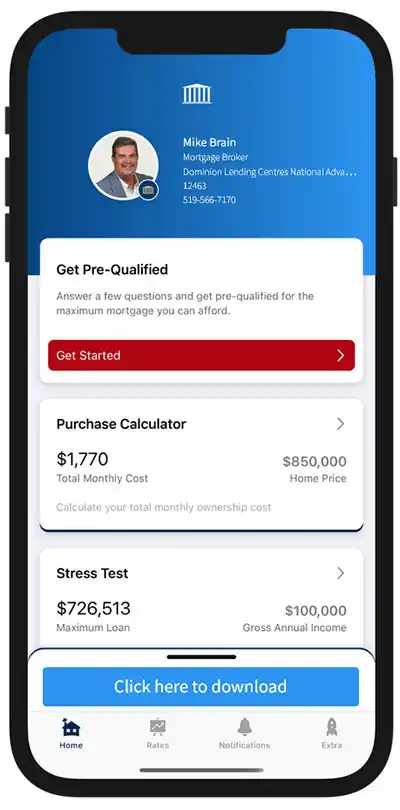

Download my Mortgage Planner App

My Mortgage Planner App gets you access to a wide variety of premium tools to help plan your mortgage.

What can you do with my app:

- Calculate your total cost of owning a home

- Estimate the minimum down payment you need

- Calculate Land transfer taxes and the available rebates

- Calculate the maximum loan you can borrow

- Stress test your mortgage

- Estimate your Closing costs

- Compare your options side by side

- Search for the best mortgage rates

- Email Summary reports (PDF)

- Use my app in English, French, Spanish, Hindi and Chinese

What clients are saying

read all testimonialsAt DLC Advantage Mortgages, we specialize in helping Windsor homeowners unlock the value of their properties through Home Equity Loans and simplify their finances with Debt Consolidation Mortgages.

Whether you're looking to renovate your home, pay off high-interest debts, or gain better control of your finances, we offer tailored mortgage solutions to meet your needs. With our deep knowledge of the Windsor market, we guide you through the process to ensure you get the best possible outcomes.

Discover how you can leverage your home’s equity today and take a significant step towards financial freedom.

Schedule a Consultation with Our Mortgage Experts Now!

What is a Home Equity Loan?

A Home Equity Loan allows you to borrow against the value of your home, offering a lump sum of money for various needs. In Windsor, many homeowners utilize home equity loans for projects like renovations, paying off high-interest debts, or making investments.

With competitive rates and flexible repayment terms, a Home Equity Mortgage in Windsor, ON, can be a smart financial move that opens up a world of possibilities.

How to Access Your Home Equity in Windsor

To qualify for a Home Equity Loan in Windsor, you must have sufficient equity built up in your property. Lenders typically allow you to borrow up to 80% of your home’s appraised value, minus your remaining mortgage balance. At DLC Advantage Mortgages, our team will help you assess your home’s equity and navigate the application process, ensuring you secure the best terms.

Find Out If You Qualify for a Home Equity Loan!

Debt Consolidation Mortgages: Simplifying Your Finances

A Debt Consolidation Mortgage combines multiple debts into a single mortgage, potentially lowering monthly payments and interest rates. For Windsor homeowners juggling various debts, this is a powerful solution to simplify payments and reduce financial stress.

With a Debt Consolidation Mortgage, you can consolidate debts into one monthly payment, making it easier to manage your finances effectively.

How Debt Consolidation Can Save You Money in Windsor

By consolidating your debts, you can often secure a lower interest rate compared to your current loans or credit cards. This means more money in your pocket each month, allowing you to focus on what truly matters. Imagine having one manageable payment instead of several—this can significantly alleviate the burden of financial stress.

Learn More About Our Mortgage Solutions—Get in Touch!

Benefits of Home Equity Loans and Debt Consolidation Mortgages in Windsor

Both Home Equity Loans and Debt Consolidation Mortgages provide significant benefits for Windsor homeowners. Accessing your home’s equity can fund essential projects or investments, while consolidating debt can help reduce monthly payments and interest rates. By working with a Windsor mortgage expert, you can explore options that maximize your financial flexibility and ensure you get the best terms.

The Process of Applying for Home Equity and Debt Consolidation Loans

- Get Pre-Approved: Determine how much you can borrow based on your home’s equity and financial situation.

- Select Your Rate and Term: Choose the mortgage that fits your budget and goals.

- Verify Your Information: Provide necessary documentation to complete the application.

- Enjoy Peace of Mind: We handle all the details, so you can focus on your financial future.

Why Choose Our Windsor Mortgage Experts for Home Equity and Debt Consolidation?

Choosing a local Windsor mortgage broker means you get personalized, expert advice tailored to the Windsor housing market. Our team understands the unique financial needs of Windsor homeowners and offers solutions designed to help you achieve your goals.

Whether you’re looking to tap into your home equity or consolidate your debt, we’re here to help you navigate the process smoothly and effectively.

How Windsor's Housing Market Impacts Home Equity and Debt Consolidation

The Windsor housing market can greatly affect your home equity and the options available for debt consolidation. A stable or appreciating market can increase your home’s value, giving you access to more equity.

Our local experts can provide insights into market trends to help you make informed decisions.

Ready to Unlock Your Home’s Equity or Consolidate Your Debt? Contact Our Windsor Experts Today!

Contact us today for a free consultation and find out how a Home Equity Loan or Debt Consolidation Mortgage can benefit you in Windsor. Let us help you simplify your finances and unlock your home’s value. Call DLC Advantage Mortgages today!

FAQs

What is the difference between a home equity loan and a debt consolidation mortgage?

A home equity loan allows you to borrow against your home's value, while a debt consolidation mortgage combines multiple debts into a single mortgage.

How can I qualify for a home equity loan in Windsor?

You need sufficient equity in your home and a good credit score. Our team can help you assess your eligibility.

What are the benefits of consolidating debt into a mortgage?

Consolidating debt can lower interest rates, reduce monthly payments, and simplify your finances with a single payment.

How does Windsor's housing market affect my home equity loan?

An appreciating market can increase your home's value, allowing for more equity to borrow against, potentially enhancing your financial options.

.png)

.jpg)