Mortgage Blog

Getting you the mortgage you deserve

Home Equity Loans vs. HELOC: Which is Best for Your Financial Goals?

March 13, 2025 | Posted by: Dominion Lending Centres National Advantage Mortgages

Home Equity Loans vs. HELOC: Which Option is Best for Your Financial Goals?

If you own a house in Canada, you've probably heard of home equity. But, how do you really take advantage of it? When they need money for investments, debt consolidation, or remodeling, many homeowners look into home equity loans and HELOCs. Although you can borrow against the value of your house with either option, their functions are different.

When financial circumstances emerge, homeowners sometimes mix up these two borrowing alternatives. It can be difficult to decide between a home equity loan and a home equity loan, whether you're trying to finance a significant remodel, pay off high-interest debt, or invest in prospects. Let's contrast two well-liked choices: HELOCs and home equity loans.

Home Equity vs HELOC – Insight For A Better Choice!

What is Home Equity?

The portion of your house that you own outright and are not obligated to pay back via a mortgage is known as home equity. The remaining sum would be your home equity if you sold your home and paid off all obligations backed by it.

One of the home loan choices accessible to homeowners is a home equity loan. It functions almost like a Home Equity Line of Credit (HELOC), but it takes a more organized approach, much like a traditional mortgage. In essence, a home equity loan functions similarly to a second mortgage. It has its own costs and repayment schedule and is issued independently of your initial mortgage.

Like a conventional mortgage, you get the whole amount of a home equity loan at closing. After that, the borrower makes consistent monthly payments to cover principal and interest for the duration of the loan.

Home equity loans can be helpful for people who require a large sum of money for a particular reason, even if they offer less flexibility than HELOCs.

Home equity example:

A person may take out a home equity loan to finance schooling or house improvements. Borrowers who want financial assurance can also benefit from these loans. They want to know when their loan will be fully repaid and the precise amount they will pay each month.

What Can You Really Do With Home Equity?

Green Upgrades - Apply for federal funds such as the Canada Greener Homes Loan to install solar panels or energy-efficient windows. Consolidate your debt by switching from credit card rates of 20%+ to a loan rate of 6–8%. This helped one Halifax client save $400 a month.

Education - Some people use HELOCs to avoid paying interest on student loans as tuition costs rise.

Investment Properties - Rentals are attractive because of low vacancy rates in places like Montréal.

How Does a Home Equity Loan Work?

With home equity, you can typically borrow up to 85% of the value of your house less the amount you owe on your mortgage. You will be given a certain amount upon approval, which you will repay at a certain interest rate. You will pay back the loan over a specified number of years in equal installments, just like you would with a conventional mortgage.

A home equity loan is frequently used to cover a significant, one-time investment because the money is paid out in one lump sum, such as installing a swimming pool in the backyard or combining high-interest debt into a single loan with a lower interest rate.

What is a HELOC?

Accessing a preapproved line of credit based on your home equity is made easy with a home equity line of credit, often known as a HELOC. This credit is available for use whenever you need it.

How Does a HELOC Work?

Like a home equity loan, a HELOC normally allow you to borrow up to 85% of the value of your house, less any existing mortgage balance. It functions more like a credit card than a conventional mortgage, though. You can easily access your revolving line of credit with a HELOC throughout the 'draw period,' which is a predetermined borrowing period that typically lasts ten years. To access this cash, your lender frequently offers checks, a credit card, or a debit card.

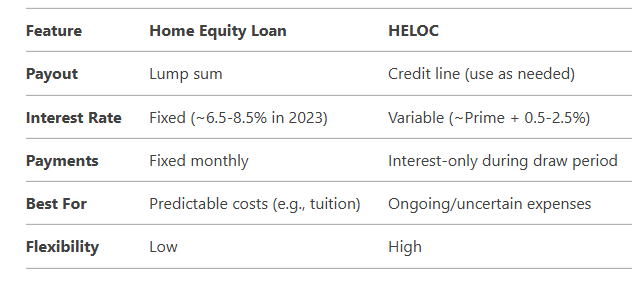

The thick line of difference between HELOC and home equity loans is the “interest rate”. HELOCs typically have a variable interest rate, whereas home equity loans usually have a fixed rate. This implies that even though the interest rate usually has a fixed upper and lower cap, your monthly payments may vary.

You might also be able to pay just interest during the draw period. Following the conclusion of this time frame, you will enter a repayment phase during which you will start making interest payments in accordance with the conditions you have agreed upon with your lender.

Similar to home equity loans, a HELOC can be used for a number of things, including paying for medical bills or house renovations. A home equity mortgage, such as a HELOC, may be the best option for you if you're looking at home loan options as it allows you to access the money you require while leveraging the value of your house.

Head-to-Head: Which Wins for Your Goals?

How to Get a Home Equity Agreement or HELOC?

It's always wise approach to organize your funds before beginning the loan process. Your debt-to-income ratio and credit score play a major role in determining what you can qualify for and the rates you'll pay. When you're prepared, start by contacting your neighborhood bank or credit union to get quotations for a home equity loan. When weighing your alternatives, remember to ask about closing expenses and any additional fees. .

HELOC, offered by banks or credit unions, is an additional choice if you're interested. Before choosing, be sure to examine rates and fees, just like you would with home equity loans.

Home Equity loan vs. HELOC: Pros & Cons

There are pros and cons of using a home equity loan or a HELOC. The ultimate selection will rely on your personal demands, the schedule for spending the money, and comfort with a set or changing rate.

Here are some pros and cons to consider.

Home Equity Loans

Pros:

Fixed monthly payments - With a predictable payback schedule and fixed interest rate , budgeting will be simpler.

Lump sum funding - Perfect for major needs like debt consolidation or home improvements because you get the entire loan amount up advance.

Reduced interest rates As compared to credit cards - Home equity loans frequently offer more affordable interest rates than unsecured loans.

Cons:

Higher interest rates than HELOCs - Generally speaking, fixed-rate home equity loans have somewhat higher interest rates than HELOCs.

Less flexibility - If your financial demands change after receiving a lump amount, you won't be able to take out more money.

Upfront charges - To obtain the loan, you might have to pay closing costs, appraisal fees, and other expenditures.

HELOCs

Pros:

Flexible access to funds - You only have to pay interest on the amount borrowed during the draw period.

Reduced initial payments - To keep short-term expenses down, many HELOCs permit interest-only payments during the draw period.

Possible tax advantages -The interest paid may be tax deductible if the money is utilized to upgrade your house (consult a tax professional).

Cons:

Variable interest rates - It is more difficult to forecast long-term expenses when monthly payments are subject to change.

Risk of payment shock - It can be expensive to switch to repaying principal and interest if you've simply been making interest payments.

Secured by your home - Because your home acts as collateral, you run the danger of foreclosure if you fall behind on your payments.

Which One Is Better for You?

You can borrow money for any reason with both home equity loans and home equity line of credit (HELOC). However, one can be more suitable than the other based on your circumstances. However, a home equity loan can be a better choice than a home equity line of credit if you:

- You must pay a certain amount of money for a single, significant expense.

- Like the concept of budget-friendly, fixed monthly payments.

- If you had constant access to extra money, you could be more likely to overspend.

When it comes to home equity loans, HELOCs might be a better choice if you:

- Not sure about the entire amount you will need to borrow

- You should anticipate requiring funds for a number of purchases over a long period of time.

- Accept the possibility that your needed payments and interest rate may fluctuate.

Why Should You Trust DLC Advantage Brokers?

Because our team at DLC Advantage Mortgage is always up to help and assist you with debt relief or holiday rental in Kelowna. No jargon, just plain conversation—our brokers are Canadian real estate experts. Contact us or stop by our Ottawa office for coffee.

Let's make the most of your equity! Speak with DLC Advantage Mortgage right now. Because the value of your house should bring opportunities rather than cause you anxiety.